Gold Price Analysis: The next dip may provide a buying opportunity – Confluence Detector

BY TAKER 05 AUG 2020

Gold has been edging higher but seems shy of staging a major breakout. The precious metal is pushed higher by the failure of American politicians to reach an agreement on extending federal unemployment benefits and other emergency programs. That implies a bigger package down the road – and more importantly for XAU/USD more monetary stimulus.

On the other hand, hopes for a coronavirus vaccine remain robust as Novavax and other companies are moving forward to provide immunization. Stocks, bonds, and precious metals are looking for a new direction.

How is gold positioned on the charts? Significant hurdles loom over XAU/USD, implying another attempt to push the precious metal to the upside seems futile. However, after extending the downward correction, gold may be ready for the next bullish move – as fundamentals continue pointing higher.

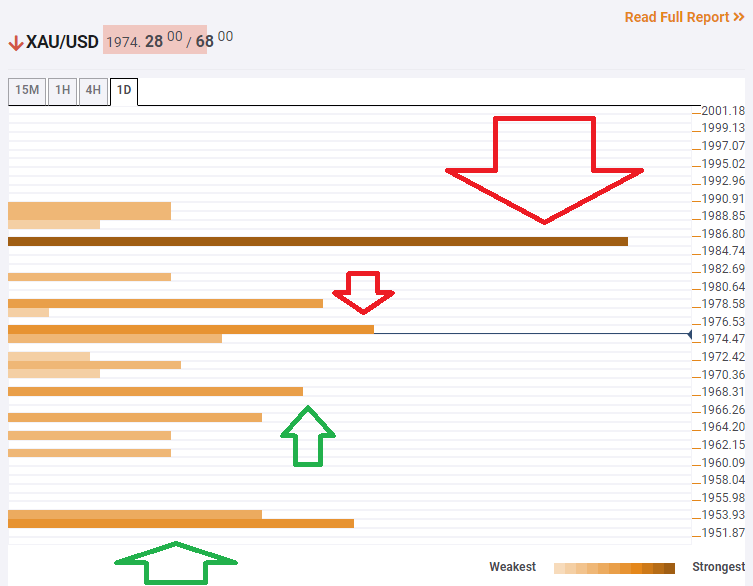

The Technical Confluences Indicator is showing that gold is initially capped at $1,975, which is a cluster including the Simple Moving Average 5-15m, the SMA 10-1h, the Bollinger Band 15min-Middle, the BB 1h-Middle, and several other SMAs.

The most significant resistance is at $1,985, which is the all-time high and also where the BB 4h-Upper and Fibonacci 23.6% one-day converge.

Some support awaits at $1,968, which is the confluence of the SMA 100-1h, the previous 4h-low, and the SMA 5-one-day.

A more considerable cushion is at $1,952, which is the meeting point of the Fibonacci 38.2% one-week and the BB 4h-Lower.

All in all, the path of least resistance is to the upside.

Key XAU/USD resistances and supports

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

0 comments: